For release 7 March, 2024

Australia’s total inaction on alcohol tax reform is looking increasingly out of step with its major trading partners, the spirits industry says.

Spirits & Cocktails Australia chief executive Greg Holland said the Federal Government must take heed of recent policy initiatives in the UK, Canada and Japan.

“Three of our most important G7 trading partners have recognised that the current economic conditions are putting unprecedented cost pressures on the industry and consumers,” he said.

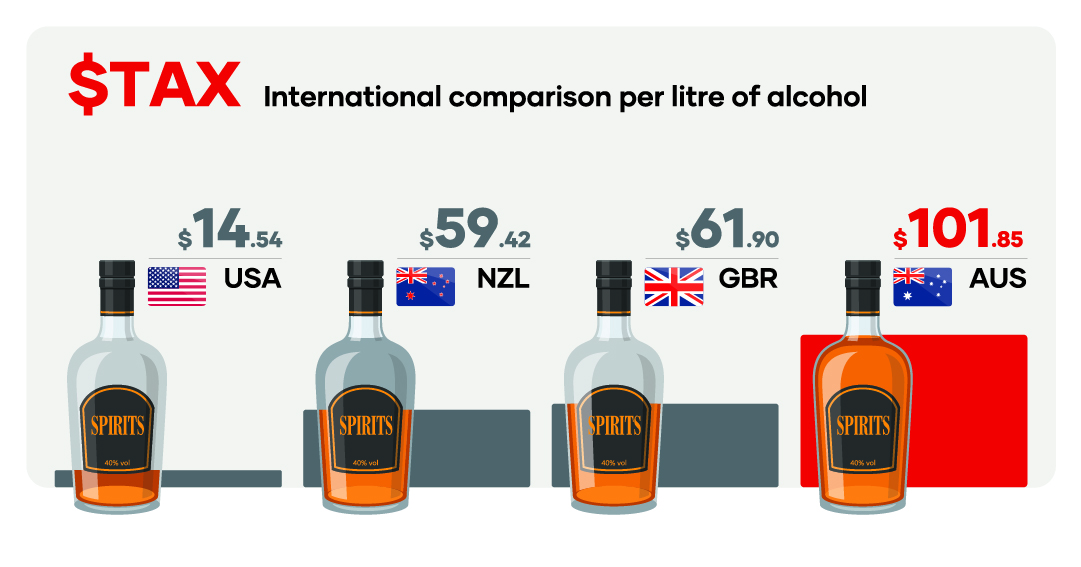

“Yet in Australia, the world’s third highest spirits tax was increased again last month to $101.85 per litre of alcohol, with another hike coming in August.

“As a result, hard-working Australians are continually being asked to pay more for their favourite spirits. For example, tax comprises 63% of the cost of a bottle of Bundaberg Rum.”

The UK Government this week extended its freeze on alcohol duty until February 2025 in a bid to relieve pressure on the industry and households struggling with the rising cost of living.

Canada cited similar reasons last year when it temporarily capped its annual inflation adjustment to excise duty at two per cent.

And in Japan, the National Tax Agency has taken steps to align tax rates and remove distortions between different alcohol categories.

Australian Distillers Association chief executive Paul McLeay said Australia’s relentless biannual indexation of spirits excise is clearly untenable against this global backdrop.

“Australia is manufacturing some of the world’s most exciting and highest quality spirits,” he said.

“We have real potential to create a major export industry in this country that will grow manufacturing jobs in the regions, where half of our 600-plus distilleries are based.

“However, this won’t happen without meaningful reform of this punitive tax, which has already increased 16 per cent in the last three years.”

Holland said the ABS’s January CPI figures once again laid bare alcohol’s contribution to Australia’s cost of living crisis, with out-of-control spirits tax the major culprit.

“A growing Australian spirits industry will promote investment and job creation across the industry and its supply chain,” he said.

“Sadly, Australia is increasingly being defined as a place where it is impossible for spirits manufacturers to do business.

“We call on the Federal Government to immediately freeze spirits tax for two years to safeguard our industry’s future and help the Government accomplish its stated mission of bringing inflation under control.”

ENDS

Media contact

James Atkinson, Media & Communications Manager

Email: jatkinson@spiritsandcocktails.au

Mobile: +61 416 870 827